New NACA System

The regional Guidance Corporation out of America (NACA) is actually designed for those with minimal assets and you will/otherwise poor credit. Brand new NACA program is a beneficial nonprofit homeownership and you will advocacy organization you to definitely was created to let homeowners confronted into the credit and very first financial support must get a home. NACA has the benefit of attractive financing below markets interest rates in place of advance payment otherwise closing costs requirements.

- Just what NACA Program Was

- Degree Requirements

- Tips of having Come on NACA Program

installment loan no credit check Hamilton

Great things about NACA

- Down costs

- Extra activities/charges

- Closing costs

- Market/a lot more than markets rates of interest

- Credit rating conditions

Interest rates

The NACA program brings very competitive financial pricing and their newest costs can be obtained right here. As of , their terminology look as follows:

Once we falter interest levels, it is essential to observe that the NACA system merely encourages the fresh new lending and cannot truly deliver the financing. Rather, might recommend your to an acting financial in their system.

Toward a conventional mortgage, private financial insurance (PMI) is usually required if you find yourself putting less than 20% of your residence’s value off once the an advance payment. For the NACA system, this new Subscription Recommendations System (MAP) takes the spot of PMI and you may pledges the borrowed funds regarding matter of defaulting.

Finally, this new Map program assists residents with budgeting and you will think in order for they can build smart monetary behavior one to hook them up getting a more financially secure future.

NACA Requirements

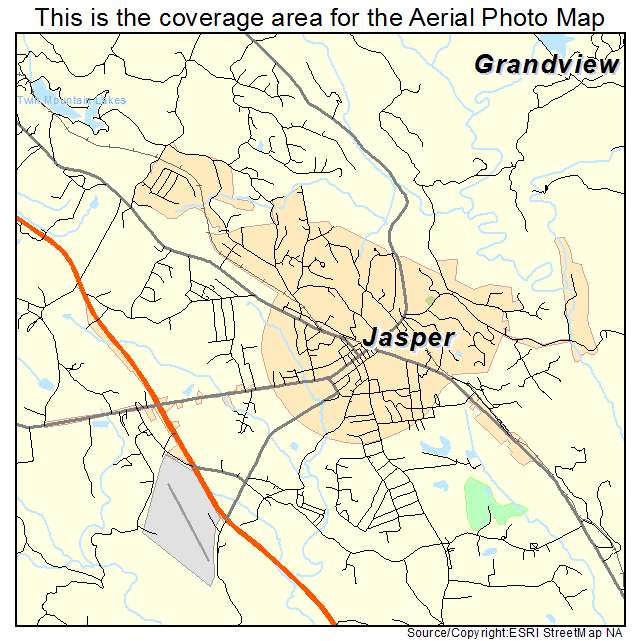

Potential homebuyers that have a household money you to falls underneath the median household income within town can buy a property everywhere in this you to considering city according to the NACA system. While potential housebuyers having highest earnings as compared to city average try only allowed to purchase a property for the portion which can be designated priority components.

One of the main appeals of NACA program is that those with lower borrowing from the bank has actually a less complicated big date qualifying for financing. When you’re antique mortgage loans look at your credit score, the latest NACA program talks about other variables instance:

- On time percentage history

As the NACA system is a wonderful replacement antique loans to own low income buyers, it is critical to be aware of the requirements which come collectively to the system.

Measures of having a NACA Financial

Now that you’ve got a far greater information with what the new NACA program requires, why don’t we enter how to begin if you’ve determined its a fit for you.

Sit-in a seminar

The first step in enabling become will be to attend a totally free homeownership working area. Speaking of hosted into the a per area basis thus find one that’s local to you. This can give further outline including the overall costs and you may certification.

Fulfill a therapist

While the workshop is complete, you will need to speak to a casing counselor to decide your budget; Like exactly how you’ll look at the pre-degree procedure on the a traditional loan.

The therapist gives you tips to be a great deal more economically secure and look from inside the seem to. If the overwhelming initially, they are there so you’re able to each step of one’s means.

Restoration means

You will then become NACA-authoritative and ought to continue steadily to create your credit. In this timeframe you are able to always pay the bills, end any brand new borrowing from the bank inquiries (handmade cards, automobile financing, etc.), and you can continue to make money in order to set money out for your home whenever you are having the ability exhibiting financial statements after to the.

Going back to some other working area. Inside workshop, you are able to work on the fresh counselor to understand functions you to fall in this your budget and get connected with a realtor that gets involved into the NACA system.

After you’ve recognized the house your shopping for to acquire, your specialist and you can realtor will assist in enabling your a degree page. In addition, you can work together locate an offer drafted with the home.

Assessment

Much like the regular real estate process, you’re getting the house checked that have good NACA performing inspector to verify there are no issues that should be addressed before stepping into your house.

Complete mortgage suggestions

You are able to today have to complete new paperwork required in purchase to theoretically meet the requirements. So it goes with step 3 just like the you’ll be able to have to submit pay stub background, bank comments, and you may evidence of toward-big date costs showing that you’ve held it’s place in a beneficial financial standing.

Closure day

Due to the fact mortgage try canned, possible meet with the merchant, their lawyer, as well as your attorneys/agent so you’re able to indication every home loan files and you can finish your house get.

What to bear in mind

A number of the drawbacks tend to be you should live in a NACA urban area, loads of constant repairs into NACA office, and buy limits for the home.

Among the best a means to best appreciate this system was to start by the probably a first time homebuyer conference.